Recent years of political and economic turmoil have shown that investing is a true art of predicting and assessing risk. The war in Ukraine has reshaped Europe's economic landscape. The current economic situation in Germany and the UK, where instead of growth we see bankruptcy and economic slowdown on the horizon, indicates that creating a stable investment portfolio may require even more attention and knowledge. So, what should an investment portfolio consist of and how to build it? Which assets should it be based on to withstand crises, wars, bankruptcies, or economic slowdowns of countries, and still generate profit?

What should an investment portfolio consist of?

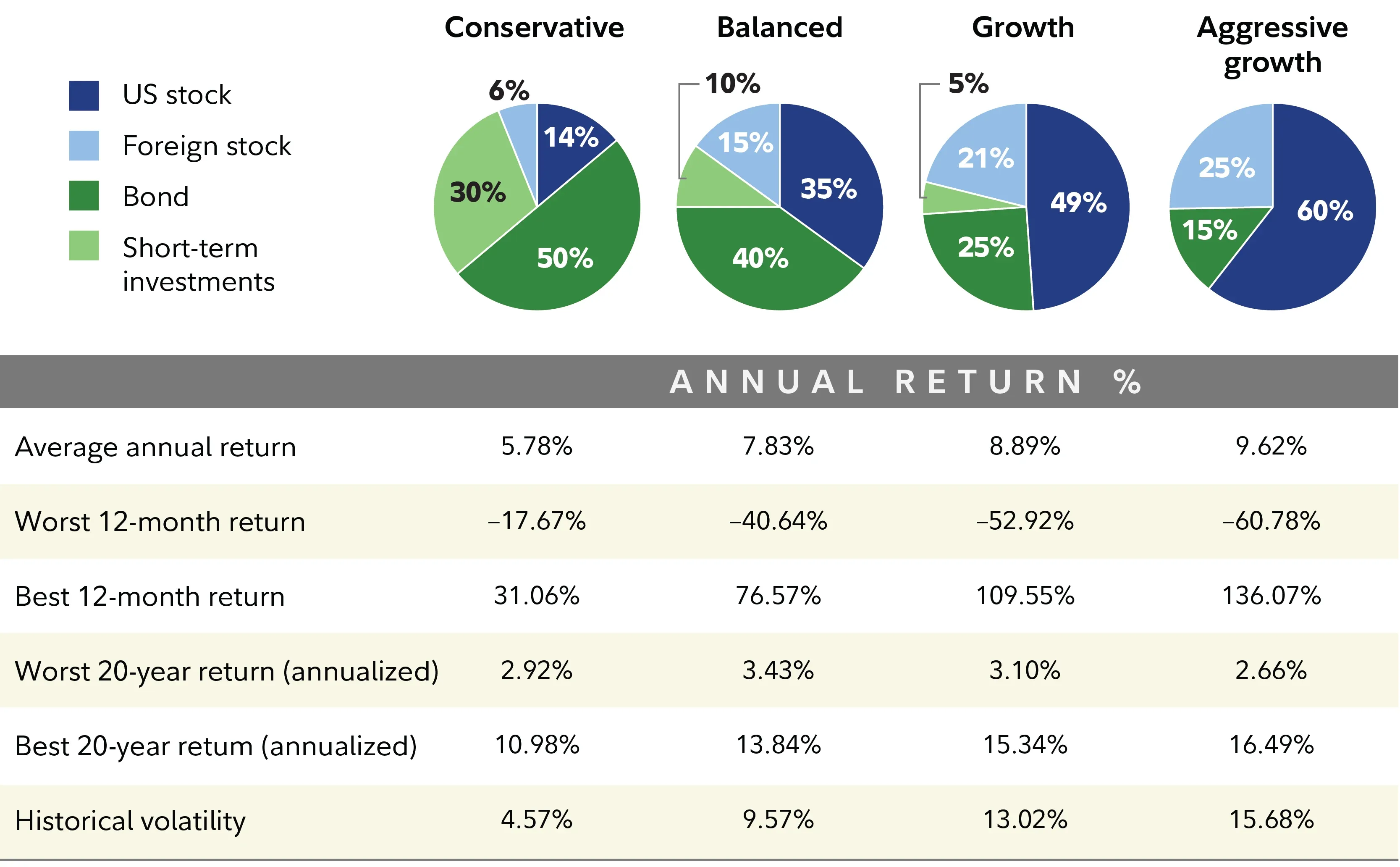

There's no simple recipe. This is because it should be a thoughtful composition of various asset classes that collectively serve one goal: reasonable capital growth with a controlled level of risk. The foundation is usually stocks. They are responsible for long-term value appreciation. Ideally, they should be sector- and geographically diversified to benefit from the development of different economies and industries, rather than relying on a single trend. Therefore, a single publicly traded company is not enough — stocks should also be selected in a way that market movements ensure stable portfolio growth.

Stocks balance bonds, especially government or high-quality corporate bonds, which serve a stabilizing role. They generate regular income and limit portfolio fluctuations during market uncertainty. A good idea is also an investment fund or ETF fund.

An important element is also cash or short-term instruments. These provide liquidity, flexibility, and the opportunity to seize investment opportunities during market downturns. Complementary assets can include alternative assets such as real estate, commodities, or gold, which often behave differently than traditional financial markets and increase the portfolio's resilience to inflation and economic turbulence.

photo: religareonline.com

However, it is not just about holding many assets, but about their conscious proportions, tailored to the investment horizon, risk tolerance, and investor's lifestyle — so that the portfolio not only "works" but also allows for peaceful sleep. And this is regardless of headlines in news outlets. Because a peaceful mind is the "reward" when you know how to consciously build your portfolio.

Conscious investing is knowing how to build a portfolio

Conscious investing is much more than just choosing assets. It is the ability to plan a portfolio based on knowledge, investment goals, and time horizon, rather than fleeting emotions or media headlines. The most important thing is to recognize your own risk tolerance and to stick consistently to the previously established proportions between stocks, bonds, cash, or alternative assets.

Investment psychology plays a huge role here. Emotions such as fear during downturns or euphoria during a bull market can lead to impulsive decisions that, in the long run, diminish portfolio performance. A conscious investor can observe the market without reacting immediately. They also apply systematic rebalancing and regular reviews. Such management helps maintain investment stability and maximizes chances for long-term success. In practice, this means investing becomes a logical and controlled process, not a series of impulsive decisions driven by emotions.

How to diversify an investment portfolio, or building a portfolio in practice

Proper diversification involves not only holding many assets but primarily selecting them in such a way that they respond differently to economic and political changes. Therefore, multi-level diversification is most important here. Proper balancing between asset classes, sectors, and regions reduces concentration risk and decreases the portfolio's vulnerability to single events.

photo: religareonline.com

In practice, this means combining growth assets with defensive ones, cyclical investments with more stable assets, and developed markets with emerging markets, whose economic cycles often proceed at different paces. An important element of diversification is also spreading investments over time, which reduces the risk of entering the market at an unfavorable moment and allows benefiting from different phases of the economic cycle.

This is complemented by regular rebalancing, which involves periodically restoring the target proportions in the portfolio. This way, the composition of the investment portfolio is continuously monitored. As a result, diversification remains an active process rather than a one-time decision. An active approach significantly increases the return rate.

A well-diversified portfolio does not eliminate fluctuations but makes them more predictable and easier to accept from a long-term investor’s perspective.

What does a safe investment mean and which assets should an investor choose in 2026?

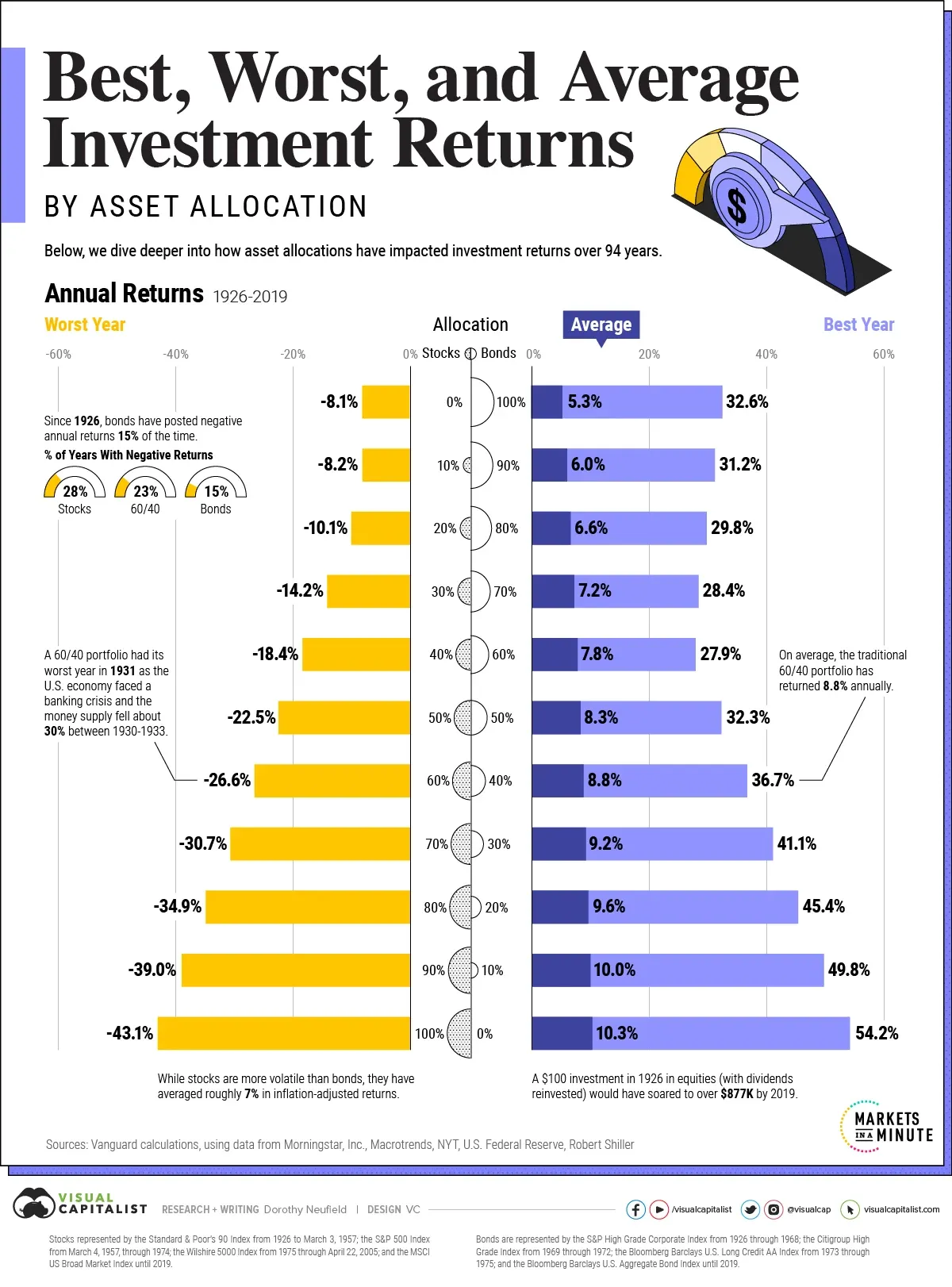

In 2026, the concept of a "safe investment" takes on particular significance in the context of a complex economic and geopolitical situation, where enthusiasm for stocks is also growing. However, investors remain vigilant about inflation, changes in monetary policy, and international tensions. The global economy is growing moderately, with significant differences between regions. Meanwhile, innovations, especially in artificial intelligence, drive growth potential while increasing market volatility.

photo: visualcapitalist.com

Under such conditions, assets perceived as relatively safe include precious metals such as gold and silver, which maintain their value during times of uncertainty and inflation. Government bonds and high-quality corporate bonds remain the foundation of capital protection, providing stable income and reducing portfolio fluctuations during tougher periods.

The stock market still offers growth potential, although the rate of returns may be lower than in the previous year. The most promising prospects are in innovative, technological sectors and in companies leveraging new consumer and economic trends. Cryptocurrencies, while still attractive to investors seeking high returns, are characterized by high volatility and associated risks. Nonetheless, they can play a growth role in a small part of the portfolio.

In summary, a safe portfolio in 2026 should combine resilience to market fluctuations with growth potential: diamonds, gold and other precious metals, high-quality bonds, and well-diversified shares of stable and innovative companies. More risky elements, such as cryptocurrencies, should be treated as a supplement, maintaining proportions aligned with your investment horizon, risk tolerance, and individual financial strategy. This way, you can build an investment portfolio that works.

Portfolio diversification versus inflation, trends, and policy

An investment portfolio is a dynamic set – its structure naturally responds to geopolitical and macroeconomic changes. During periods of international tensions, conflicts, or political uncertainty, investors often shift capital towards safe assets such as secure stocks and government bonds, gold, or cash. These assets retain value even during crises.

Markets can react with high volatility during this time, especially in sectors sensitive to global events, such as energy, transportation, or technology dependent on supply chains. Commodities, luxury goods, and gold often appreciate when inflation or geopolitical risks rise. They thus serve as a "safe haven." Cryptocurrencies and emerging markets are usually more susceptible to sudden declines but can also offer high returns during stabilization and economic recovery periods.

Therefore, effective diversification and a balanced portfolio require not only spreading capital across asset classes but also considering each asset's sensitivity to various political and economic scenarios. The goal is a resilient set that can withstand fluctuations while capitalizing on market trends.

Composition of an investment portfolio – a practical guide to safe success

Investing does not happen in a vacuum – the created set always responds to market changes, economic trends, and political events. Diversification is a tool that not only minimizes risk but also allows leveraging potential opportunities arising from market fluctuations and economic cycles. A well-diversified portfolio is not a static collection of assets but a dynamic structure capable of surviving various scenarios, from financial crises to periods of high economic growth. Its final form depends on the individual investment decisions of its creator.

Shares

They are the main growth engine. They represent the potential for long-term capital appreciation. A portfolio consisting of different stocks from various sectors usually balances dynamically. Therefore, it’s worth including different sectors – technology, healthcare, energy, finance – as well as different markets: local, developed, and emerging. The proportion of stocks depends on the investor’s profile, but in a balanced portfolio, it can be around 40–60%. Sectoral and geographical diversification reduces each portfolio’s sensitivity to local crises or regulatory changes in one region. Many aspects and data should be considered.

Investment funds and TFI and ETF funds

ETF Funds in an investment portfolio allow for simple diversification and risk reduction at low costs. They enable investing in broad stock indices, bonds, emerging markets, or commodities without purchasing individual securities. ETFs are liquid, which allows for quick portfolio adjustments, and combining several ETFs – e.g., global stocks, bonds, and real estate – creates a cohesive structure ensuring safety and growth potential. Complementary to ETFs can also be traditional investment funds, which offer professional management and access to more specialized strategies.

For investors valuing convenience and expert support, these funds can be a stable element of the portfolio, especially in areas requiring greater market knowledge.

Bonds

Bonds stabilize the investment. They generate interest income and limit portfolio fluctuations during periods of market uncertainty. Depending on risk tolerance, in a conservative portfolio they can constitute 50–70%, in a balanced one 30–40%, and in an aggressive portfolio 20–30%. Government bonds and high-quality corporate bonds provide capital protection, while inflation-indexed bonds can additionally safeguard against purchasing power decline. Therefore, building an investment portfolio without them is unthinkable.

Cash and Short-term Instruments

They form a liquidity cushion. They allow quick response to investment opportunities and protect against sudden market drops. In a balanced portfolio, cash can constitute 5–15% of the value, and in a conservative portfolio even up to 25%.

Real Estate

Real estate investments offer stable income and long-term inflation protection. They can take direct forms (properties, apartments, offices) or indirect through REIT funds. In a balanced portfolio, real estate usually accounts for 5–15%, and their value grows in regions with stable demand and limited supply. Real estate typically offers potential profits.

Commodities and Gold

Precious metals, especially gold, are classic hedges during times of political and economic uncertainty and inflation. Energy or agricultural commodities can increase the resilience of the portfolio against price fluctuations in the global economy. In a balanced portfolio, the share of gold and commodities usually ranges from 5–10%.

Cryptocurrencies

Due to high volatility and lack of long-term history, cryptocurrencies should constitute a small part of the portfolio – 1–5%. They can serve as a growth asset in the long term but are not suitable as a foundation for portfolio stability.

Own Investment Portfolio – Your Decisions, Risks, and Awareness

Building your own investment portfolio is a bit like designing your own lifestyle – it’s not just about numbers but about creating a solution that fits you and gives you a sense of control. It’s worth starting with simple questions: why am I investing, for how long, and what level of risk am I willing to take?

A conscious approach involves having a plan and sticking to it even when things get noisy around you, because in the long run, it’s calmness and consistency that build true strength.