Just a decade ago, a mountain resort apartment was primarily a dream come true—having your own place to relax. Today, it more often represents a legitimate investment asset. European Alpine resorts, spa towns, and developing mountain centers attract not only tourists but also investors seeking tangible assets that are resistant to inflation and market fluctuations. Apartments in the mountains for sale are increasingly seen as a safe asset in an investment portfolio. But is it worth investing in mountain apartments? Is it a good way to allocate your capital for the years to come?

Investment apartment in the mountains - is it worth investing in property in 2026?

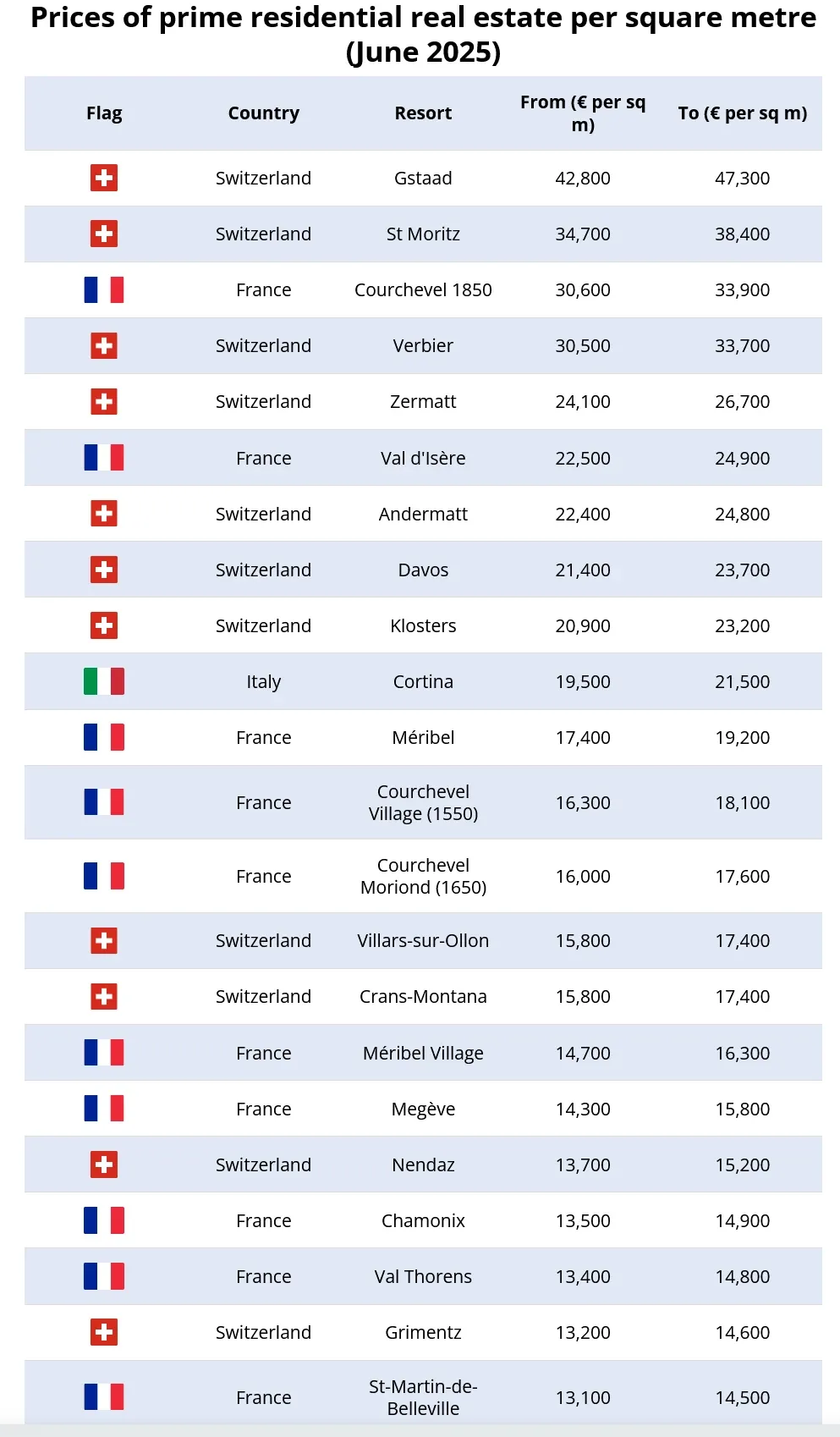

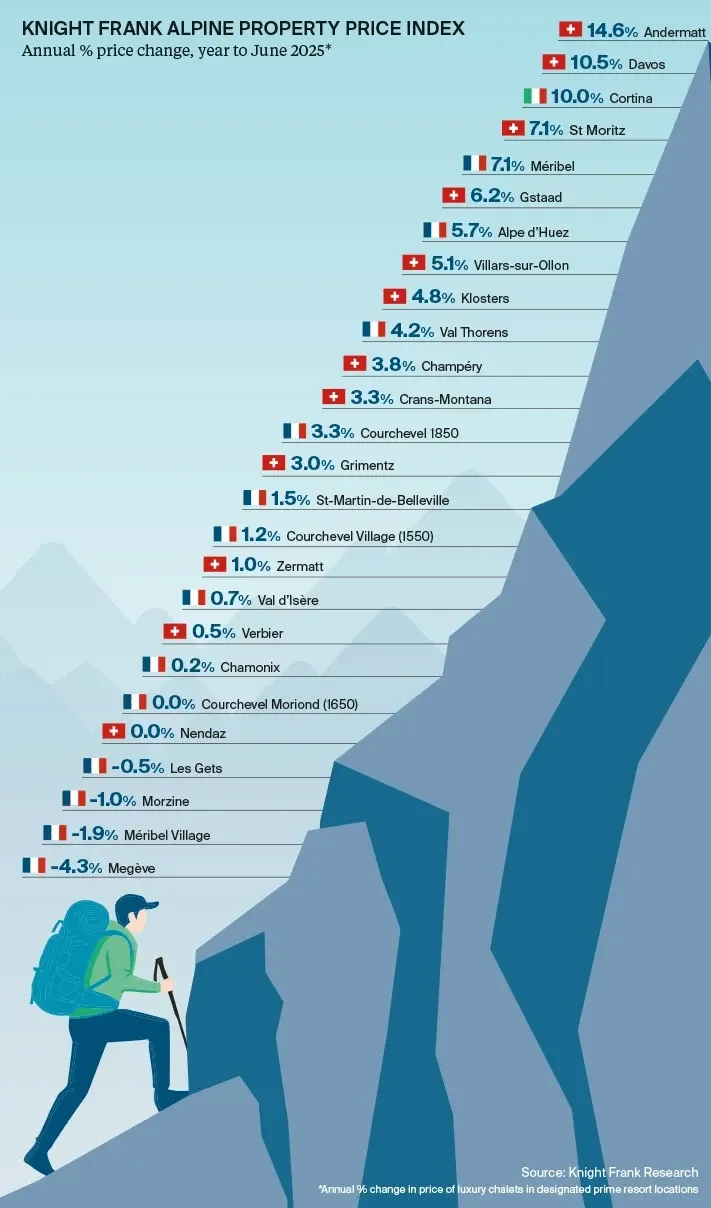

In 2026, purchasing an apartment in the mountains in Europe remains attractive, although increasingly selective. The best results are achieved by top resorts in Switzerland, France, and Austria, as well as selected resorts in Norway and northern Italy. The Alpine Property Index provides a good overview of mountain investments. Last year, it increased by 3.3%. The highest price increases occurred in Swiss resorts due to strict legal regulations.

photo: skisolutions.com

Limited land supply, restrictive building regulations, and the growing trend of year-round mountain living – encompassing not only skiing but also wellness, hiking, remote work, and premium tourism – create a solid foundation for property value growth. Their attractiveness is increasing. The entry threshold is high, but the profit is almost certain.

Is it worth investing in mountain apartments? - find out what we know

Investing in mountain apartments in Europe in 2026 is based on solid market data. These show a clear difference between premium locations and properties available on the mass real estate market. In prestigious Alpine resorts, property values remain at very high levels.

For example, in Courchevel, apartment prices start at around 11,000–14,000 euros per square meter. In the ultra-luxury segment, prices often exceed 25,000–30,000 euros/m². In Andermatt, Val d’Isère, Méribel, or Megève, average prices today hover around 10,000–15,000 euros/m². In popular but more accessible Alpine or Norwegian locations, entry is possible from about 4,000–8,000 euros/m².

From an investor’s perspective, not only is the appreciation important – which in the best resorts has often been 20–40% over the last 10 years, with moderate further increases of 2–6% annually – but also income potential and stability. Therefore, an investment apartment in the mountains is an excellent idea for regular income.

How much can you earn from a mountain guesthouse?

In prestigious Alpine resorts such as Courchevel, Val d’Isère, or St. Moritz, occupancy during the winter season usually reaches 70–80%, and 50–65% in summer. This translates into revenues of around 400–900 euros per m² of rental space annually. For a guesthouse of about 500 m², this means gross income of 200,000–450,000 euros per year. In more accessible locations like Zell am See, Schladming, or Garmisch-Partenkirchen, realistic income more often falls within 250,000–350,000 euros annually, with net profitability at 8–12%. Meanwhile, smaller guesthouses in Norwegian resorts such as Trysil and Hemsedal typically generate 150–300 thousand euros per year.

photo: euronews.com

Therefore, purchasing property in the best locations is a good idea for portfolio diversification.

How much can you earn from renting out an apartment?

In renowned Alpine locations such as Courchevel, Val d’Isère, Zermatt, rental rates during the winter season typically range from 3,000–6,000 euros per week. In the premium segment, it can be as high as 8–9 thousand euros, which, with good occupancy, allows generating annual gross revenues of around 35,000–70,000 euros from a single property in attractive locations. In popular but more affordable resorts like Zell am See, Schladming, or Chamonix, typical rental income most often falls within the range of 20,000–40,000 euros per year, with seasonal occupancy of 50–70 percent.

Conversely, in developing locations such as Norwegian Hemsedal or Trysil, property owners usually achieve annual revenues of 15,000–30,000 euros.

photo: euronews.com

After deducting management, service, taxes, and local fees, the actual net return on rental investments most often ranges from 3–9% annually. Therefore, mountain apartments are not only a place for leisure but also a stable source of income and a component of a long-term investment strategy.

Investing in an apartment, where location matters – French Alps, Swiss Alps, or maybe Norway?

Investing in mountain properties in Europe is no longer a niche strategy for skiing enthusiasts. It is a conscious choice for individuals seeking to combine lifestyle with real financial potential. In recent years, the market has clearly shown that it is not “the mountains” as such that determine the success of an investment, but specific location, year-round accessibility, resort reputation, and the business model—whether we focus on rental apartments or a guesthouse as an actively managed business. Below is a summary of the most well-known and proven investment destinations along with what can realistically be expected from them.

Most well-known mountain locations for real estate investment

photo: knightfrank.co.uk

• Swiss Alps – Adarmatt, St. Moritz, Verbier, Zermatt, Gstaad

Characteristics: ultra-premium market, very limited land supply, strong international demand, high resilience to crises.

Investment certainty: very high – this is a direction for those focused on capital preservation.

Apartment in a premium segment or luxury condo-aparthotel.

Return: 3–6% net annually from rental income, value appreciation of 2–4% annually in the long term.

Who for: investors with a larger budget, a safe and prestigious form of investment, high potential profits

• French Alps – Courchevel 1850, Val d’Isère, Méribel, Chamonix, Megève

Characteristics: very strong tourism and ski market, excellent infrastructure, high seasonal demand and improving summer demand.

Investment certainty: high, though more cyclical than in Switzerland.

Model: both an investment apartment and a small guesthouse in a good location.

Return: 4–7% net from rental, value growth of 2–5% annually.

Who for: investors looking to combine rental income with moderate property value growth. Rental yields are very high.

• Austria – Kitzbühel, Lech, Zell am See, Schladming

Characteristics: very good accessibility, family tourism, stable demand for most of the year.

Investment certainty: high, market more “value for money” than ultra-luxury.

Model: apartment for short-term rental or a small guesthouse in a picturesque setting.

Return: 5–8% net with good management, value growth of 1.5–3% annually.

Who for: investors seeking a balance between purchase price and profitability.

• Italy – Cortina d’Ampezzo, Val Gardena, Madonna di Campiglio

Characteristics: prestigious locations, increasing international recognition, strong lifestyle brand.

Investment certainty: medium to high.

Model: apartment in a good location or boutique guesthouse.

Return: 4–7% net from rental, potential value growth of 2–4% annually.

Who for: investors valuing lifestyle and the development potential of premium mountain tourism.

• Norway – Hemsedal, Trysil

Characteristics: rapidly developing market, increasing number of foreign tourists, good air accessibility.

Investment certainty: medium.

Model: investment apartment in a project with a professional operator.

Return: 6–9% net in the best projects, value growth of 2–3% annually.

Who for: investors seeking higher profitability with a lower entry price than in the Alps.

• Resort spas and smaller mountain towns – e.g., Bad Gastein, Bad Ischl, Davos Dorf, smaller towns in the Alps

Characteristics: stable, year-round demand based on wellness, rehabilitation, and tranquil tourism. Many amenities.

Investment certainty: good with proper location selection.

Model: small guesthouse or aparthotel.

Return: 5–10% net with active management, value growth of 1.5–3% annually.

Who is it for: investors looking to run a more operational business rather than just making a passive investment. A slightly more risky investment in an apartment.

Photo: travelandleisure.com

Mountain apartment in a renowned resort - is the appreciation of property value certain?

A property in a prestigious mountain resort offers not only stunning views but also a typically stable capital investment and a way to diversify. In locations such as mountain resorts, limited land supply, a steady influx of tourists, and increasing popularity of mountain living contribute to a long-term upward trend in apartment prices.