Apparently, women love diamonds. But not only women. Investors also adore them. Why? Because along with gold and art, they are a stable way to invest capital. From time to time, at auctions in renowned houses such as Sotheby's or Christie's, unique diamonds of extraordinary size or clarity, colorful and extremely rare fancy diamonds, or jewelry art pieces appear. The interest from investors and collectors always exceeds expectations, and the final prices—estimates. However, investing in diamonds is not just about hunting for one-of-a-kind pieces, but about conscious and safe selection. So how to buy diamonds? Is it still worth investing in gemstones?

What are the best diamonds to invest in? - Find out which stones are safest to purchase

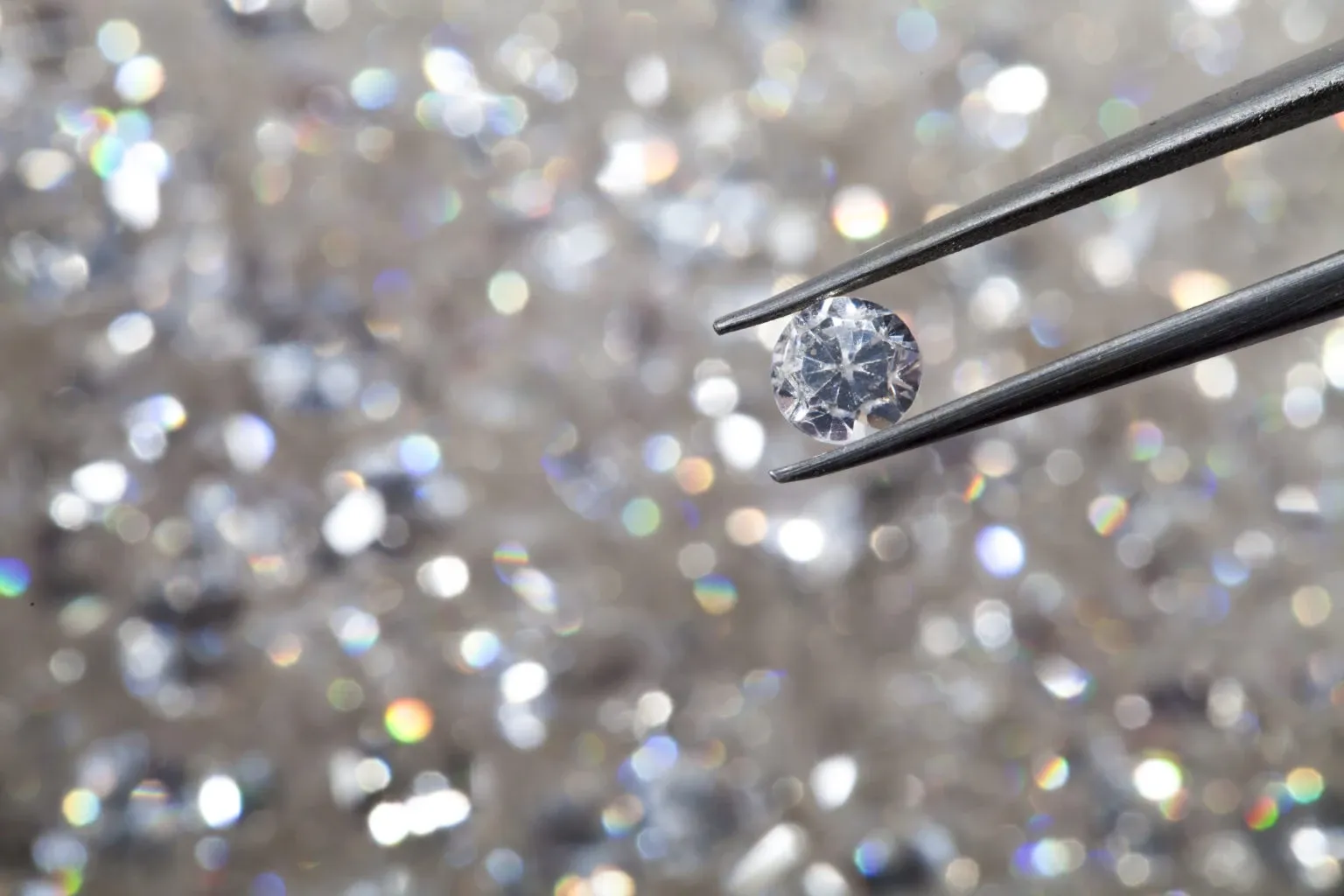

In changing market conditions, experts emphasize that the safest investment choice is diamonds with the highest quality parameters – so-called investment-grade stones. Quality is always a good form of investment. They stand out with excellent features according to the 4Cs criteria, confirmed by certificates.

photo: gia.edu

Investors are also particularly attracted to rare colored diamonds, especially pink and blue. Their unique color makes them truly valuable stones. Origin is important – ethically sourced diamonds currently hold higher value. Buying diamonds requires a lot of knowledge and attention.

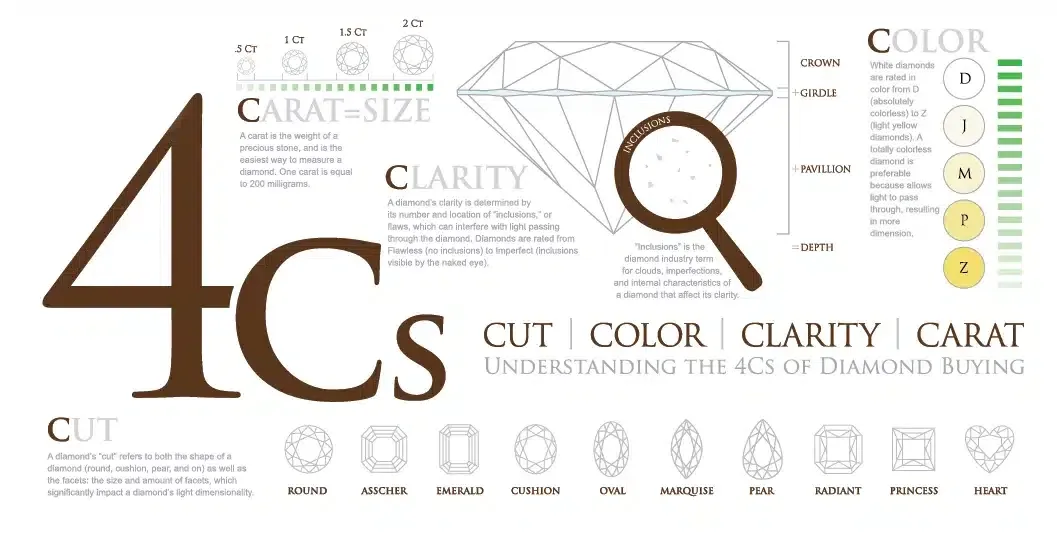

The 4Cs Principle

The 4Cs principle is an international standard for assessing diamond quality. It describes four characteristics that determine the value and appeal of a stone – both in jewelry and investments.

photo: moissanitegemstone.com

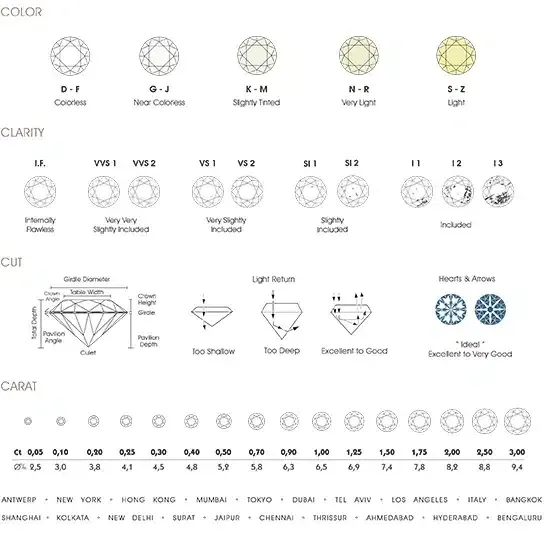

1. Carat (weight)

- Defines the diamond's weight.

- 1 carat (ct) = 0.2 grams.

- The larger the diamond, the higher its price, but the price increases exponentially – e.g., a 2-carat stone may be worth more than twice as much as a 1-carat one.

2. Cut

- Refers to proportions, symmetry, and quality of the cut, not the shape of the stone.

- The best is an ideal cut (Excellent) – maximizes the stone’s brilliance.

- Poor (Poor, Fair) cuts reduce value even with high carat or color grades.

3. Colour

- The GIA scale ranges from D (colorless) to Z (noticeably yellow/brown).

- Diamonds in D-F grades are the most expensive.

- Colored diamonds are assessed on a separate scale.

4. Clarity

- Indicates the presence of inclusions (internal) and blemishes (external).

- Scale from FL (Flawless) – perfectly clean, to I3 (Included) – with numerous visible flaws.

- The most common in investment trading are grades from IF (Internally Flawless) to VS1/VS2 (Very Slightly Included).

photo: igi.org

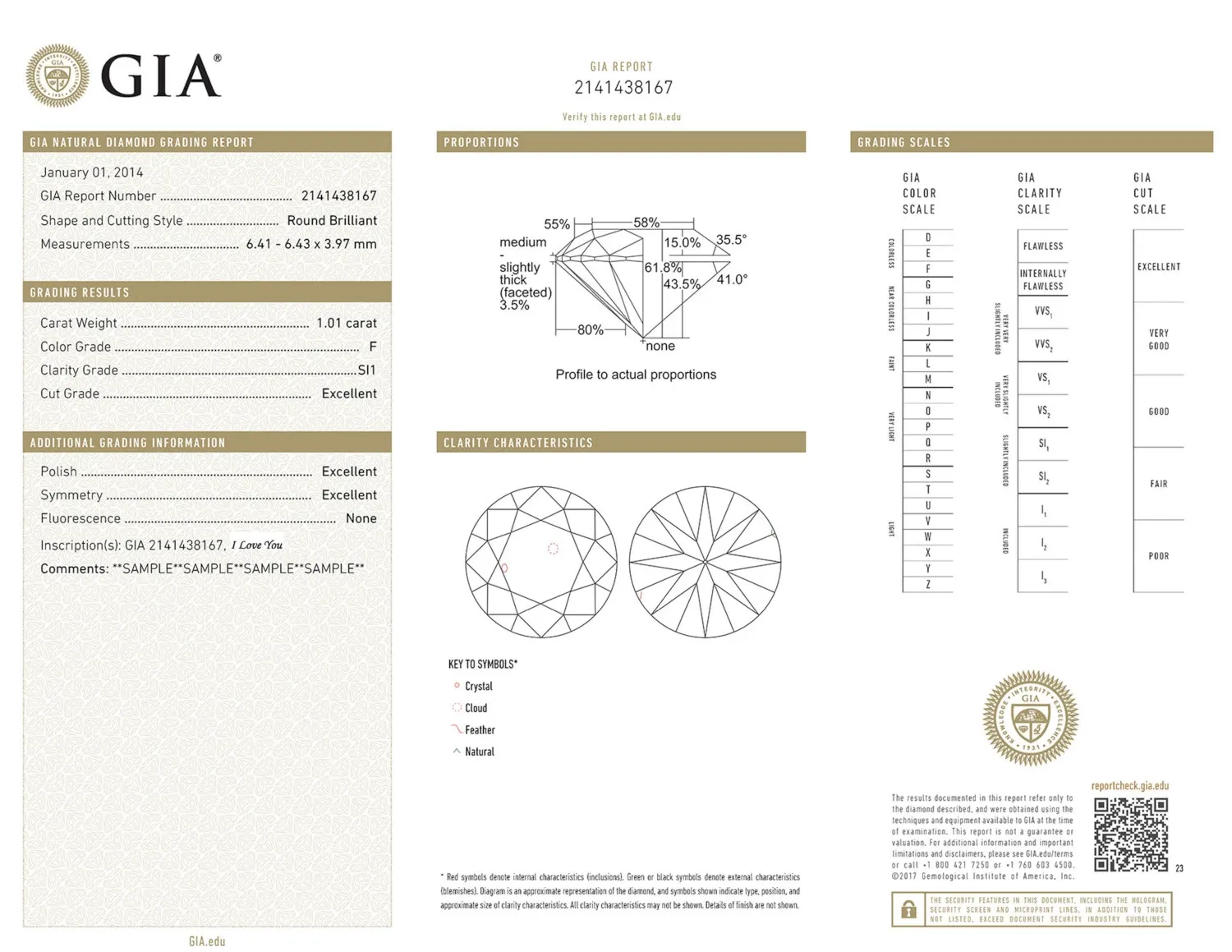

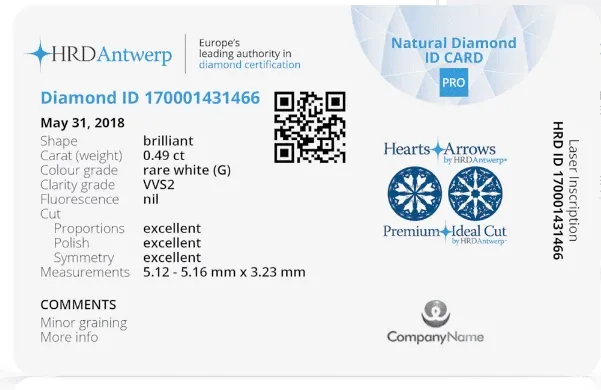

What are diamond certificates and why are they so important?

Diamond certificates are independent documents issued by specialized gemological laboratories. They confirm the authenticity and quality of the stone. They contain detailed information about the characteristics and an identification number of the stone. They increase purchase security and facilitate resale later. Therefore, it’s advisable to seek advice from a credible expert before buying.

Most recognized diamond certificates:

GIA – Gemological Institute of America

photo: gia.edu

The most credible certificate in the world, valued for its rigorous and objective evaluation criteria. The international GIA laboratory certificate inspires trust and provides confidence in long-term investment.

HRD – Hoge Raad voor Diamant (Antwerp)

Photo: https://hrdantwerp.com

An authority in Europe, especially popular in the Belgian and German markets. Valued and recognized worldwide.

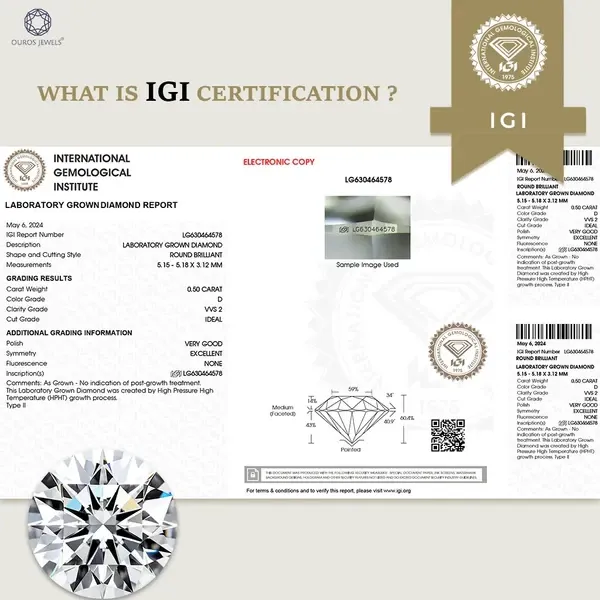

IGI – International Gemological Institute

IGI certificate for investment diamonds, sample, photo: igi.org

Widely used in retail trade. Slightly less strict than GIA but broadly accepted.

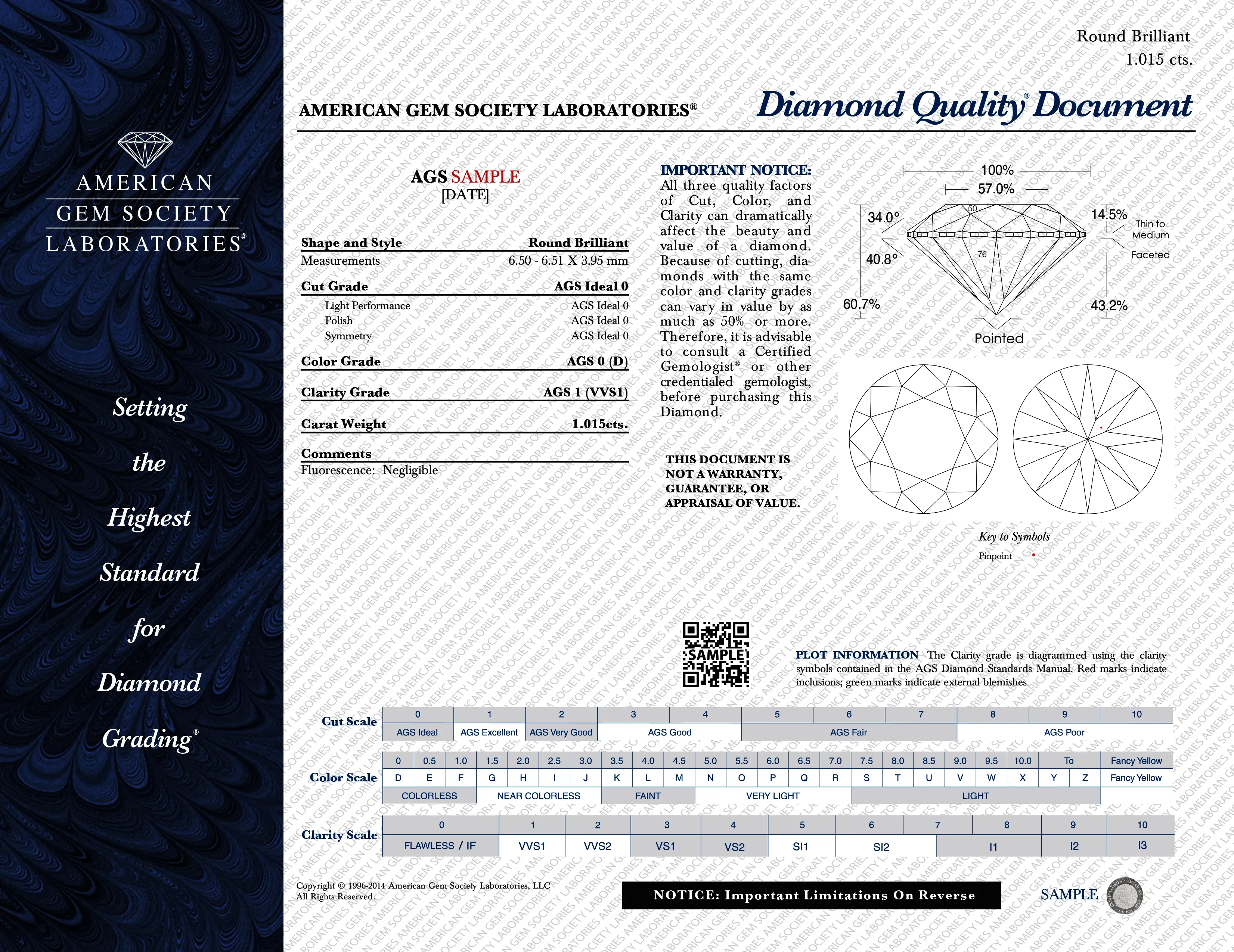

AGS – American Gem Society

Photo: americangemsociety.org

Specializes in detailed cut analysis. Mainly valued in the USA. Contains detailed information about the stone’s parameters, such as cut, color, clarity, and weight, ensuring its authenticity and value.

IGA – International Gemological Appraisers

A less known but market-present certificate issued by laboratories mainly operating in the USA and Asia. Not always accepted as equivalent to the above.

It is worth investing in diamonds with a reputable certificate. It confirms the high value of the stone.

How much does an investment diamond cost?

Prices of investment diamonds can be surprising – both in scale and volatility. Everything depends on the class of the stone. That’s why the 4C rule is so important. For a 1-carat diamond with the highest parameters (color D, clarity IF, Excellent cut), with a GIA certificate, you need to pay from $10,000 to $25,000. But that’s just the beginning – stones with rare colors (so-called fancy diamonds) can cost hundreds of thousands or even millions per carat. The value of a diamond also depends on its origin, polishing quality, and symmetry, as well as the global market situation.

Photo: americangemsociety.org

Although prices have declined since 2022, the best stones still hold their value – making them an excellent hedge against inflation.

What is an investment diamond?

When it comes to diamonds, investment is only worthwhile in a natural, well-cut stone of the highest quality. Remember that an investment diamond, although beautiful, is not jewelry with diamonds. To meet the criteria, the stone must have excellent quality parameters (4C). Such stones come exclusively from legal sources, most often from mines in Botswana, Canada, Russia, or South Africa.

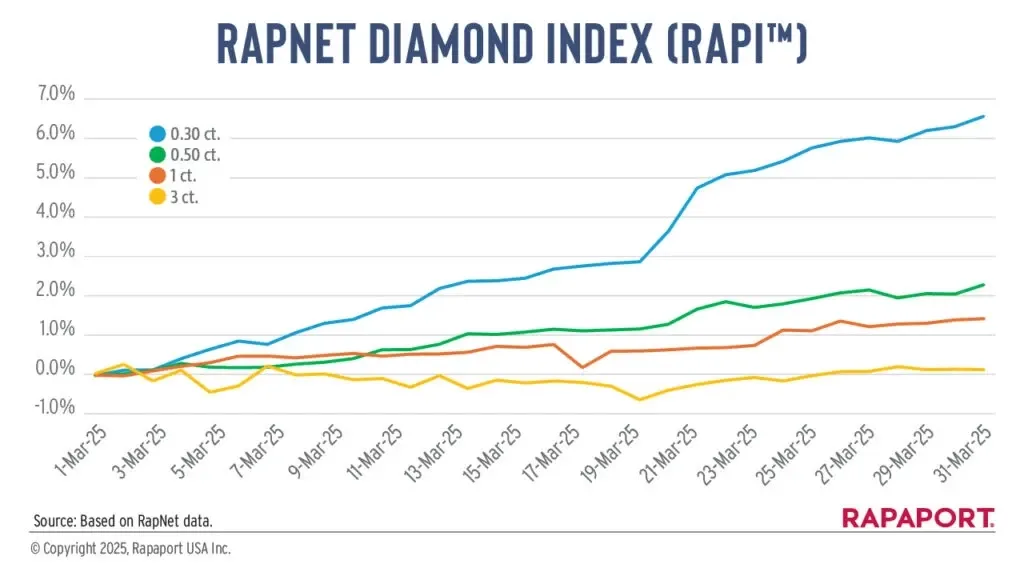

Diamond Investment - Indices and Quotes

Indices such as the IDEX Diamond Index and RapNet Diamond Index serve as indicators for investors. Both measure changes in diamond prices on the global market. Currently, experts believe that despite declines, purchasing diamonds is a good idea. Diamonds can be a valuable way to diversify an investment portfolio and achieve long-term gains.

IDEX Diamond Index

The IDEX Diamond Index is one of the main indicators tracking the prices of polished diamonds on the global market. It measures price changes for diamonds with various quality parameters such as carat, color, clarity, and cut. This allows investors to monitor overall market trends, which, despite short-term fluctuations, show a long-term upward tendency.

RapNet Diamond Index

This index focuses on wholesale diamond prices. It tracks changes in gemstone prices, considering their different quality features. The index is an important source of information for buyers seeking to understand price trends in both retail and wholesale markets. It provides data on demand and supply for diamonds.

Thanks to it, investors can monitor how the market reacts to changes in diamond supply and global economic factors.

Photo: rapnet.com

Investment Diamond as a Capital Investment and Diversification Method

an effective way to protect capital. Unlike traditional financial assets, diamonds are resistant to inflation, easy to store, and not directly affected by stock market fluctuations. The resources of natural diamonds are limited, and their extraction is becoming increasingly costly, which investors see as a source of long-term stability. Today, gemstones are not only prestigious acquisitions but also potential assets for wealth protection in times of market uncertainty. Are they a way out of a crisis?

If you are looking for investment diamonds - contact us at - biuro@luxuryproducts.pl

Mobile +48 660 777 937

Mobile +48 577 036 777