Alcohol has been known to humanity for a long time. So why should a beverage that is so common and almost everyone can make at home be considered an investment? Paradoxically, something as widespread as a bottle of wine can be a perfect investment and a way to diversify capital. This phenomenon is clearly and steadily confirmed by the cyclical auctions of rare bottles at Sotheby's or Christie's, which ignite investors' imaginations. They are an excellent example of interest in wine. On the other hand, distributors and producers of this drink are increasingly experiencing declines on a large scale. This indicates fluctuations in the stock and asset markets. Meanwhile, many owners of local wineries, seeing drops in sales of subsequent vintages, are expanding their offerings to include tours and tastings, opening up to tourists similar to Scottish distilleries. So, is it worth investing in wine? Is buying wine still profitable?

Is buying wine a good investment?

Much of this depends on your knowledge and capital. Are we talking about purchasing a unique bottle at an exclusive auction? Or perhaps we prefer wines, for example from Maltese vineyards, which are produced in very limited quantities and already have significant value at the moment of distribution? Here, bottles are manually rotated during aging or a cork is inserted.

Vineyard Marsovin, photo: JB and PG

It is worth considering whether we are investing in this noble drink to create a collection. Or perhaps it is one of the ways to diversify capital. Do we buy a bottle of wine, or are we interested in financial instruments and stocks? In that case, the area of interest is the stock exchange.

Alternatively, investing in wine could take the form of purchasing a vineyard in sunny Italy or Spain and building your own brand or continuing old traditions. It’s worth considering whether wine is a business opportunity or a way of life.

1. Investing in wines and the investment wine market — how to buy wine?

Investment wines are those with the potential to increase in value in the future, both due to their quality and rarity. There are bottles on the market that have high value at the time of purchase, but over time their price can increase.

photo: napareserva.com

Often, these are wines from renowned wineries, e.g., Bordeaux, Burgundy, Tuscany, which produce limited editions in small quantities. Investment wine also includes rare bottles that have become icons, e.g., Romanée-Conti, which fetch record prices at auctions. Interestingly, most of these are red wines.

Investment potential of fine wine

Investing in investment wines carries risks, but with the right selection of wines, such as Château Lafite Rothschild or Pétrus, investors can expect high returns. The most expensive wine in the world is Domaine de la Romanée-Conti 1945, which was sold at auction in 2018 for over 2 million złoty. In 2018, a bottle of Château Lafite Rothschild 1982 reached a price of 54,000 zł at auction. Such rarities also have collector’s value. Importantly, wines from Bordeaux or Petrus increase in value over time.

2. Wine auctions and unique prices

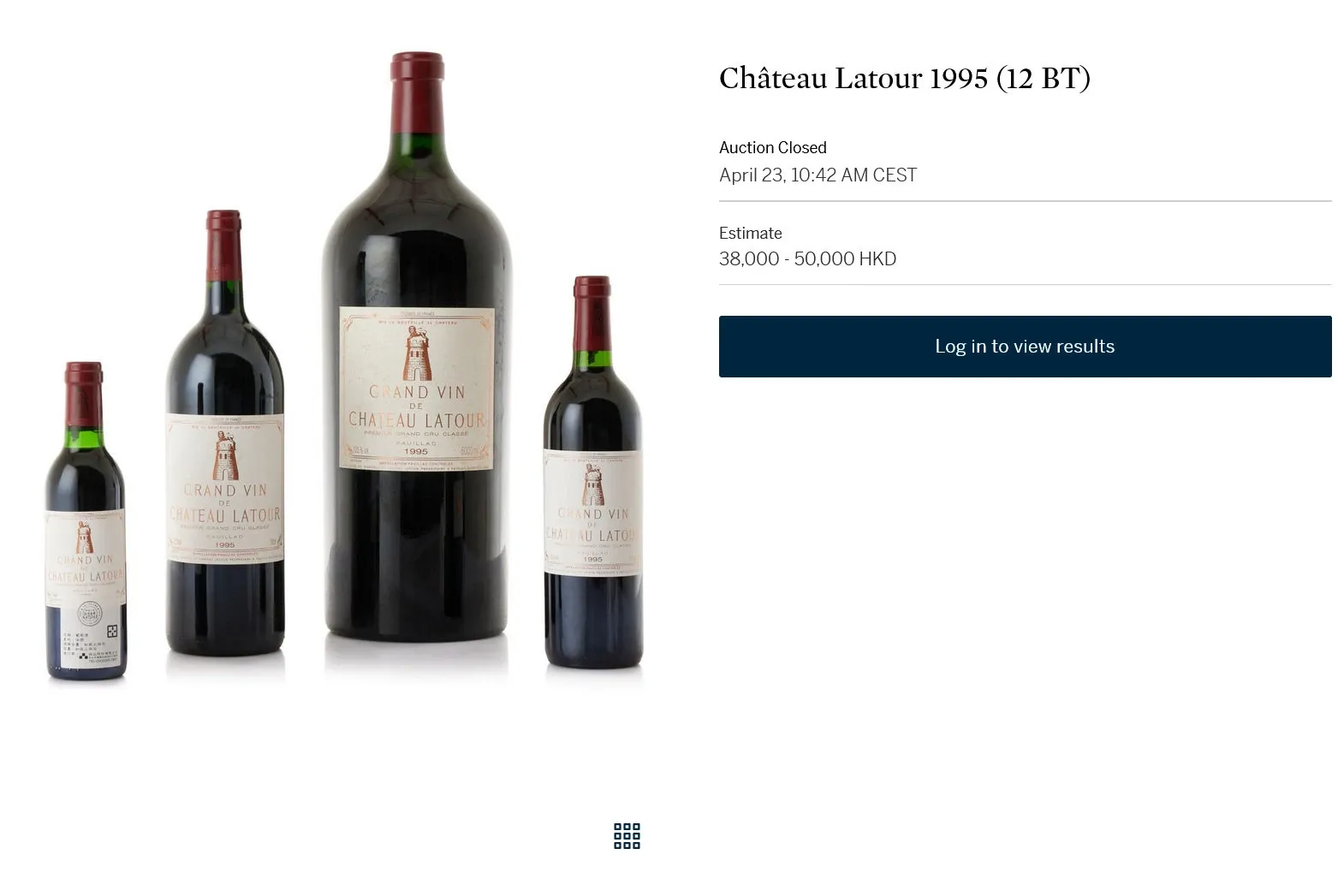

Wine auctions are one of the places where you can invest in the most expensive and rarest specimens. The most expensive wine sold at auction was Château Lafite Rothschild 1869, which reached a price of $233,000 per bottle during an auction in 2010. At auctions such as Sotheby’s or Christie’s, you can find bottles from limited editions, rare vintage wines, or unique collections.

Sotheby's Hong Kong rare wine auction, photo: sothebys.com

Is it worth investing in collectible wine?

Wines that reach such high prices are often seen as an alternative form of investment. However, it’s important to remember that not every wine will become a “rare find”. Investors need to have knowledge of the subject to make the right choice. Annual returns from investing in rare wines can range from 8% to 15%, depending on the vintage and winery reputation. However, to invest in auction rarities, it’s advisable to have knowledge about history, trends, and wineries. That’s where a true collector wins.

3. Investing in indices and company stocks

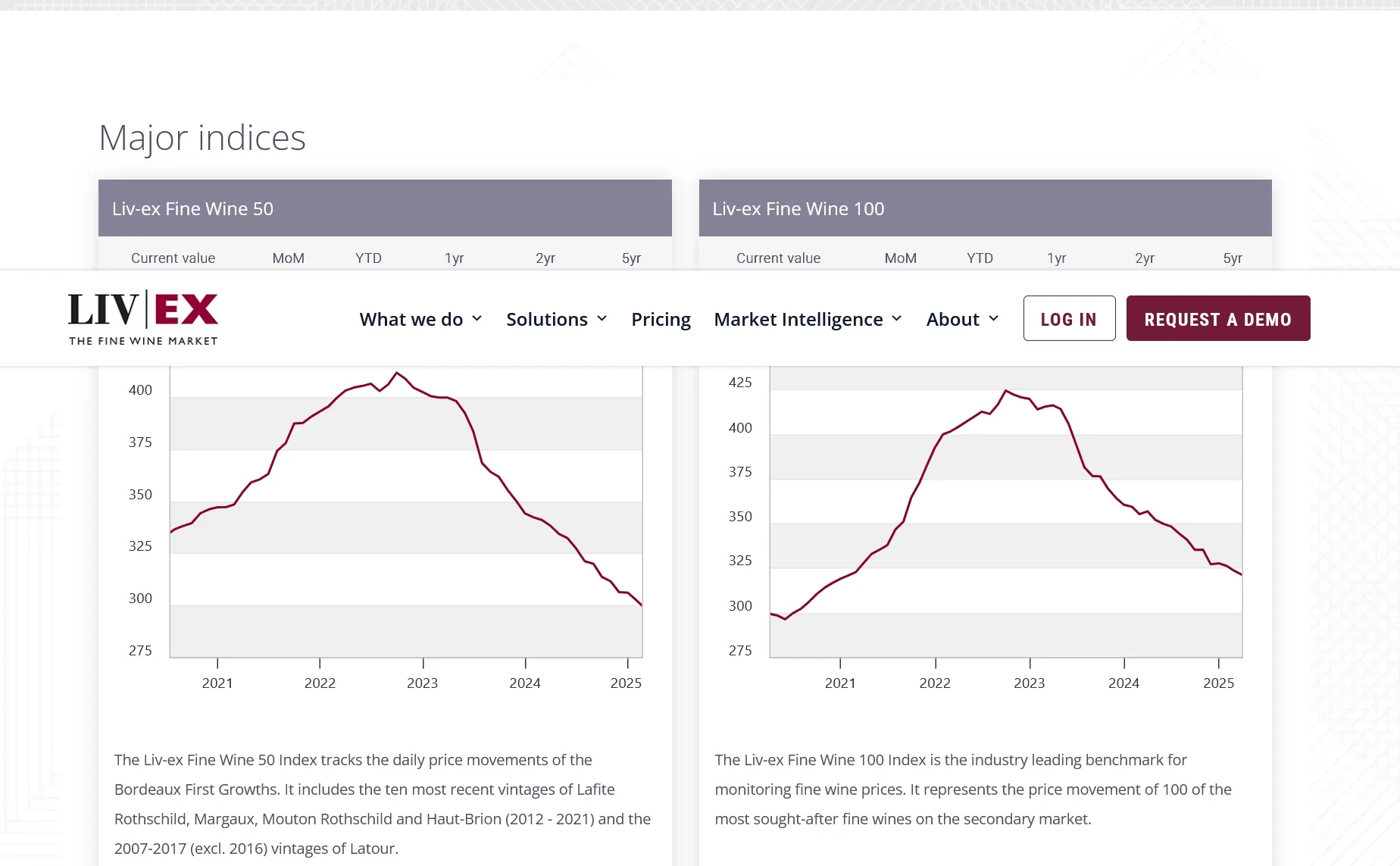

An alternative to physically purchasing a bottle of wine is investing in wine indices and shares of companies involved in wine production. There is the Liv-ex Fine Wine 100 Index, which tracks the prices of the 100 most valuable wines on the market. Investing in indices allows investors to participate in the wine market without owning physical bottles. You can also invest in shares of wine-producing companies such as Treasury Wine Estates, Concha y Toro, or Pernod Ricard.

Investment potential worth exploring

Wine indices have increased by approximately 130% over the past 10 years, and investing in shares of wine companies can provide stable returns, especially in globally operating firms. Shares in wine companies also provide access to dividends, which can be an attractive source of passive income. Importantly, current trends show that indices are experiencing a downward movement.

The Liv-ex index charts show a downward trend, photo: www.liv-ex.com

4. Investing in purchasing your own vineyard, i.e., how to create and store wine

Buying a vineyard is an investment in real estate that can become a lifelong passion. Investors who take this step can not only profit from selling wine but also build a wine brand that they can promote on the market. Owning a vineyard can generate income not only through wine sales but also via wine tourism and event organization. In this case, the retail price of wine is just a component of the return.

photo: freepik.com

The best regions for real estate investment, not just Burgundy

Buying a vineyard in regions such as Tuscany, Bordeaux, Rioja, or California involves significant initial costs (from 500,000 to several million euros), but also offers great potential for long-term profits if the vineyard is well managed. Alcohol produced in your own vineyard can reach high market prices, especially if it stands out for its quality and reputation.

5. Purchasing an existing vineyard and brand - selling wine on your own terms

Alternatively, investors can choose to buy a vineyard that already has an established brand and history. This type of investment carries less risk than starting a vineyard from scratch, as the business is already operating and generating revenue.

photo: JB and PG

Can investing in wine become a passion?

Buying a vineyard with a well-established brand offers a chance for stable income, especially if the brand has a loyal customer base. The value of such an investment will grow as the company develops, and the investor can profit both from production and from selling wine under the existing brand.

Changes in alcohol fashion

It is worth noting that although the wine market remains stable, it is undergoing certain changes that may influence its further development and investment returns. On one hand, wines continue to enjoy popularity, but on the other hand, increasing interest in alternative alcohols such as craft beer or low-alcohol beverages causes a slight stagnation in this area. This could affect prices and demand for certain vintages.

Investing in wine, stocks, and indices versus rare bottles – how to invest in wine without losing?

Investing in wine — both through purchasing unique bottles, indices such as the Liv-ex Fine Wine 100, and buying shares of companies involved in wine production — is an attractive way to diversify your capital, especially in times when financial markets are subject to strong fluctuations caused by geopolitical decisions. The choice of the right investment path should depend on available capital and the investor’s risk profile. With smaller funds (from a few thousand euros), it will be more accessible to buy shares of large wine corporations or ETF funds linked to the luxury alcohol market. However, it is important to remember that these are sensitive to market volatility just like other securities. Investment platforms can be helpful in this area. Sometimes, a sommelier can also come in handy.For those with larger capital (from several tens of thousands of euros and above), considering the purchase of investment wines is advisable. The key here is selecting bottles from renowned producers from the best vintages, using professional advisors, and ensuring proper storage under controlled temperature and humidity conditions. Equally important is appropriate insurance for the collection (a policy covering theft, damage, or natural disasters is essential). For the wealthiest investors, an alternative may be purchasing shares in professional investment cellars or even owning their own vineyard. Luxury spirits, including high-quality wines, are increasingly recognized as a wealth preservation tool in difficult times — their value rarely correlates directly with stock indices, and the limited supply of the most prized vintages further enhances their attractiveness as defensive assets. However, to truly avoid losing on wine investments, in-depth market knowledge, a long-term approach, and awareness that liquidity (the ability to sell quickly) of such assets may be limited are necessary.

Unique wines straight from auctions — which vintages and wineries are trusted by investors?

The investment wine market revolves around a few dozen of the most renowned producers and legendary vintages, which fetch the highest prices at auctions and constitute a stable capital investment. Investors primarily seek wines with limited production, excellent critic reviews, and documented aging potential.

- Bordeaux (France): Château Lafite Rothschild, Château Mouton Rothschild, Château Margaux, Château Latour, Château Haut-Brion — vintages: 1982, 1996, 2000, 2005, 2009, 2010.

- Burgundy (France): Domaine de la Romanée-Conti (especially Romanée-Conti Grand Cru), Domaine Leroy — vintages: 1999, 2005, 2010, 2015.

- Tuscany (Italy): Masseto, Tenuta San Guido (Sassicaia), Ornellaia — vintages: 1985 (Sassicaia), 2001, 2016.

- Piedmont (Italy): Giacomo Conterno (Monfortino Barolo Riserva), Gaja — vintages: 2000, 2013.

- Napa Valley (USA): Screaming Eagle, Harlan Estate — vintages: 1992, 2007, 2012.

Small boutique wineries:

- Marsovin (Malta) — limited editions, e.g., "Primus" or "Cheval Franc" — valued for rarity and quality.

- Sine Qua Non (USA) — micro-productions of cult wines in California.

- Penfolds (Australia) — especially the legendary Grange Hermitage.

- Vega Sicilia (Spain) — Unico and Valbuena, appreciated for durability and prestige.

5 wines that surprised the wine market

- Domaine de la Romanée-Conti Romanée-Conti Grand Cru 1945 — sold for $558,000 in 2018.

Photo: JB

Investing in rare wines requires not only capital but also knowledge – by choosing prestigious vineyards, exceptional vintages, and limited editions, investors increase the chances of significant growth in the value of their portfolio over time.