Gold has always carried a certain symbol — simultaneously a pragmatic refuge for capital and a source of investor concern when markets navigate uncharted waters. And now, in 2026, this shine has taken on a new dimension. After a spectacular price rally in 2025 — which pushed the precious metal's price to an unprecedented level above $5,000 per ounce — the question is no longer theoretical: will gold maintain this trajectory, or is a correction imminent? Let’s see what reports from Reuters, ING, and J.P. Morgan from December 2025 and January 2026 indicate. Is buying gold a good investment now? This question recurs regularly, but in 2026 it sounds particularly loud. Gold enters the new year after one of the strongest price rallies in history, balancing at levels that until recently seemed unimaginable. For some, this confirms its role as the “ultimate safe haven” in a world of indebted nations, geopolitical tensions, and eroding trust in currencies. For others — it’s a warning sign that enthusiasm may have outpaced fundamentals.

Is buying gold a good investment right now?

In light of historic gold price increases and growing macroeconomic uncertainty, forecasts from major financial institutions become particularly significant for investors considering whether to enter this asset class now or wait. J.P. Morgan analysts maintain a bullish outlook for the coming quarters. They indicate that investor and central bank demand — even at record-high prices — could sustain a significant upward trend and lead to an average price above $5,000 per ounce by the end of 2026, assuming the continuation of diversification trends and expected interest rate cuts in the USA. So, is it a good time to buy gold? Should you wait for the price to drop slightly?

Forecasts by J.P. Morgan, photo: jpmorgan.com

Meanwhile, ING’s forecasts are more moderate but also point to a continued bull market in 2026, with the average gold price significantly above current levels. This is driven by sustained institutional demand, anticipated actions by central banks, and expectations of further monetary easing. Various models and market analyses confirm that the fundamentals supporting precious metals — such as geopolitical uncertainty, dollar depreciation, and a consistently high appetite for capital protection — still favor gold as part of an investment portfolio. However, most scenarios also emphasize that the path to new highs may not be linear and could be volatile. Therefore, investing in gold makes sense, but with caution and thorough analysis.

Investing in gold in 2026 — yes, but wisely

Investing in gold in 2026 is a bit like sailing in waters that can still surprise you. The trends are moderately optimistic. Central banks continue to buy, institutional investors maintain a strong appetite for the metal, and J.P. Morgan, Reuters, and ING suggest that the fundamentals for gold are solid, although the journey to new peaks won’t be straightforward.

photo: investopedia.com

This means that entering the gold market makes sense, but with caution — instead of jumping all in at record prices, it’s better to spread the investment over time, combining more liquid instruments like ETFs with a small portion of physical coins or bars for security.

This approach allows you to benefit from growth potential, leverage all the advantages of investing in gold, and minimize the risk that a sudden drop could wipe out part of your capital. In practice, it involves planning multiple transactions, monitoring the market, and viewing gold primarily as a diversification and capital protection element, rather than a quick way to hit record highs. Such an approach allows investors to enjoy both the metal’s shine and peace of mind, knowing they are managing risk.

Can you lose money by investing in gold?

Demand for gold remains high. Although gold has long been regarded as a safe haven, its purchase is not without risk and can sometimes turn out to be a poor investment. Market history shows that even the most valued precious metal undergoes periodic corrections and stagnation phases. When looking at gold in 2025, we tend to forget this. But there is never a perfect moment to buy gold, and you can even lose money on it.

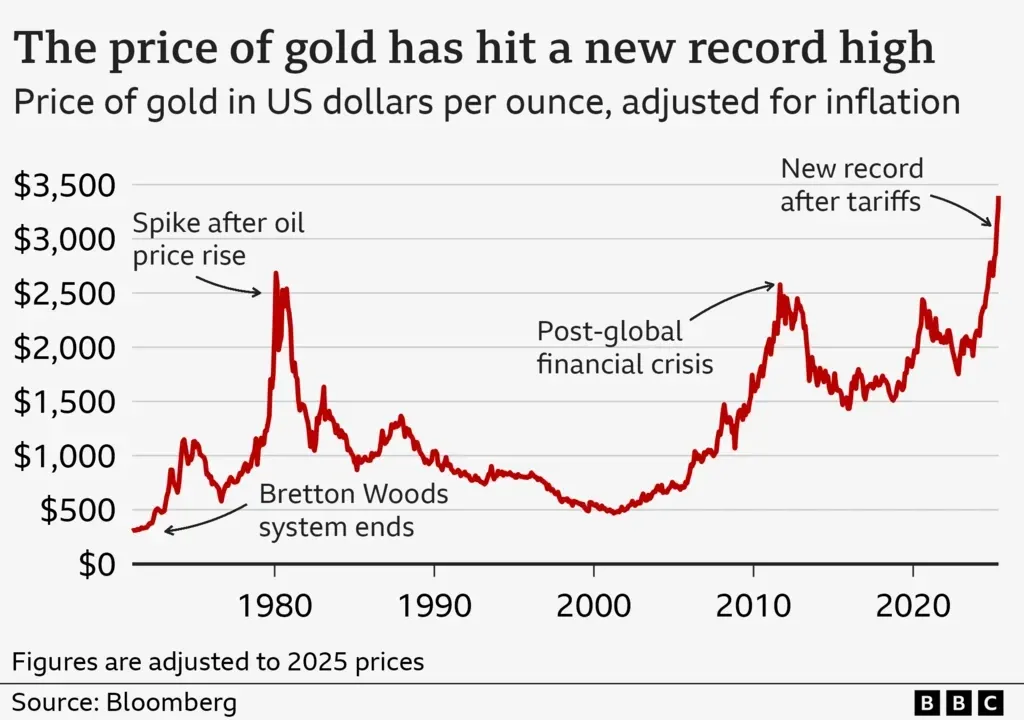

An excellent example is the gold market in 1980–1982: after a rapid rally in 1980, when the price reached around $850 per ounce in the United States (which, when converted to today's dollars, would be significantly higher than current record levels), there was a multi-year correction that lowered the price to about $300 per ounce. Similarly, after the global financial crisis in 2011: following a peak of around $1,900 per ounce, gold spent several years in a consolidation phase, and investors who bought at the top were unable to realize a profit for a long time.

Unsuccessful gold investments usually result from entering the market at peak phases, a lack of understanding of market mechanisms, and unpreparedness for price fluctuations, which can be significant at record levels—reaching even 20–30 percent. Physical gold also requires proper storage and insurance. Meanwhile, financial instruments linked to the precious metal, such as ETFs, although liquid, are subject to market influences and do not offer a steady income. As a result, investors expecting quick profits or viewing gold as the only way to protect their wealth may experience substantial losses—especially when the bull market ends or when changes in interest rates and dollar strength work against the value of the precious metal.

photo: BBC

For this reason, gold—whether as financial assets or in bars and coins—best fulfills its role within a diversified portfolio. As a means of capital protection and stability during uncertain times, not as the sole investment instrument. Like any financial asset, it has its pros and cons. Therefore, those who are not prepared for periodic downturns and market volatility should approach it cautiously, treating the purchase of precious metals as a strategic allocation rather than a reaction to media headlines or short-term price increases. Every investment carries some risk.

Is it better to sell gold or hold onto it?

If you already have gold in your investment portfolio, 2026 is not the time for impulsive moves but for strategic planning. High prices tempt to “close the chapter” and realize profits, but it’s also hard to ignore the fact that the fundamentals that elevated gold to current levels largely still hold. Geopolitical instability, a volatile US dollar, conflicts in Europe, the Middle East, or South America do not favor sudden moves.

photo: bullionvault.com

Central banks are not withdrawing from purchases, institutional investors treat the metal as a safeguard, and macroeconomic uncertainty remains a constant factor in the landscape. In such an environment, gold functions more as a solid pillar of a portfolio than a speculative ballast—provided its share does not get out of control.

Gold sales make sense primarily when its weight in your portfolio has significantly exceeded initial assumptions or when you need liquidity for other investments with higher growth potential. Holding the entire position may also be justified. Especially if you treat gold as a long-term capital safeguard rather than a source of current profit. An increasingly common compromise is a phased approach: part of the gold is sold to "take profit" and restore balance to the portfolio, while the rest remains as a buffer in case of market turbulence. This strategy allows balancing two needs — realizing profits and maintaining protection — without having to guess exactly where the market peak is.

In practice, 2026 favors such decisions: calm, portfolio-structured, rather than headline-driven. Gold does not have to be sold entirely or held reflexively. It works best when it remains a well-considered element — not the main focus, but a stable background that gives the investor confidence to act regardless of which direction the market takes.

Investing in gold as portfolio diversification

For years, gold has played a unique role in investors’ portfolios — serving both as a diversification tool and a form of capital protection during uncertain times. It is unaffected by inflation. In 2026, its importance does not diminish. J.P. Morgan’s forecasts indicate that demand from central banks and institutional investors may still drive prices, while ING points to the possibility of periodic consolidation but also emphasizes gold’s lasting value as a protective asset in times of lower interest rates and macroeconomic tensions. This means that for a diversified investor holding stocks, bonds, or real estate, a small exposure to gold can significantly reduce portfolio volatility and improve resilience to market shocks.

Investing in gold in 2026, photo: fortune.com

In practice, this means gold does not have to be the main source of profit but rather an element that provides peace of mind during crises, acting as a counterbalance to riskier assets. Such an approach allows investors to benefit from potential price increases as well as the natural correlation of gold with other asset classes, making the portfolio more stable regardless of market direction.

Forms of investing in gold and inflation

Investing in gold during periods of high inflation takes various forms — from physical bars and coins, through ETFs, to mining company shares — each reacting differently to rising prices and interest rates. Physical gold and gold-backed ETFs are most often considered as a hedge for the purchasing power of capital, although they do not generate current income. Conversely, mining stocks may offer higher profit potential but are more sensitive to market fluctuations and operational costs.

Gold coin

This is a classic form of investment that combines the security of the precious metal with ease of storage and liquidity. Popular bullion coins, such as Krugerrand or Maple Leaf, are readily available on the market, and their value is almost entirely based on gold content. For an investor, purchasing investment gold is a straightforward way to gain exposure to the precious metal.

Gold bar

photo: investopedia.com

This is a more "raw" form of investment, offering pure exposure to the price of the metal and often a lower spread compared to spot price. Gold bars are ideal for those thinking long-term and wanting to easily incorporate gold into their investment portfolio, treating it almost like a safe value fund.

Gold jewelry

This is a specific form of investment — here, besides the value of the precious metal, the craftsmanship of the jeweler and the brand also matter. Jewelry auctions show that items from well-known jewelry houses or unique vintage pieces can fetch prices well above the gold value itself. This makes jewelry both an investment and a collector’s art object, although liquidity is lower than in the case of coins or bars.

Gold indices and ETF funds, a convenient way to buy gold

They allow investing in the metal without physical storage, offering high liquidity and the ability to quickly rebalance the portfolio. This is a convenient solution for investors who want exposure to gold within a larger portfolio, leveraging market trends without dealing with the logistics of physical metal.

Is it still worth buying gold and why is gold popular?

Is it worth buying gold in 2026? The metal has been attracting investors with its shine for years, but it’s not just about the “wow” effect. In 2026, it remains popular because it acts as a financial safety cushion — regardless of stock market fluctuations, interest rates, or monetary policy. Central banks continue to buy precious metals, storing gold in bars. Central bank gold purchases are deliberate and ongoing. However, for an individual portfolio, gold is a way to diversify and protect capital.

Advantages of investing in gold still outweigh the disadvantages in 2026

In practice, this means that a wisely diversified investment — part in physical coins or bars, part in ETFs — allows you to benefit from growth potential without sacrificing peace of mind. This makes gold no longer just a symbol of wealth, but a smart tool in a world full of uncertainty and volatility. In 2026, we can still expect further gold price increases, but without rallies.