Gold has long been regarded as a safe haven in times of economic uncertainty. Its value can be influenced by factors such as global tensions, currency fluctuations, or decisions made by central banks. Understanding the impact of these elements on the price of gold, as well as investment strategies, can help in making informed decisions. In this article, you will learn about various aspects of investing in gold that can significantly affect your investment portfolio.

Types of Investment Gold – Bars and Coins

When choosing investment gold, you can opt for bullion bars or coins. Bars are solid pieces of gold weighing from 1 gram to 1 kilogram, often packaged in CertiPacks for security. Meanwhile, bullion coins, such as Krugerrand or Maple Leaf, are easy to sell and feature beautiful designs. Both bars and coins are available at reputable stores that guarantee their high quality and authenticity, making them a solid form of investment, such as IDF Metals.

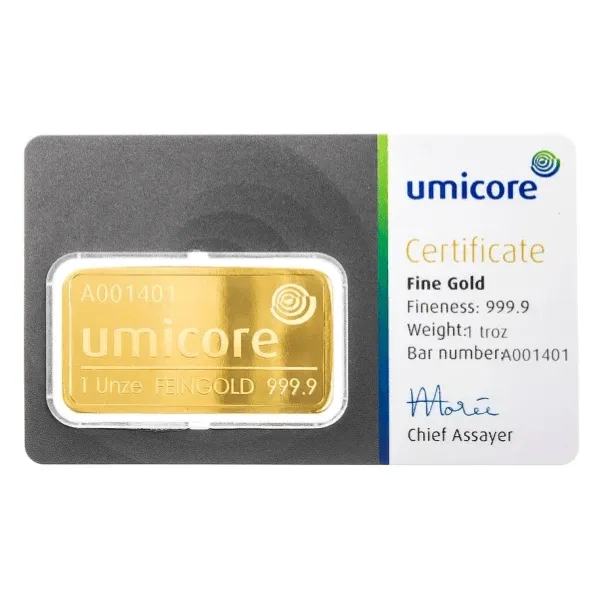

Gold Bars

They have very high purity and come in various weights. You can select a weight that fits your budget, from small 1-gram bars to kilogram-sized ones. A very popular choice is 1-ounce gold bars. This allows you to invest both small amounts and significant sums. The most important aspect of gold bars is that they are authentic and of good quality. The price of gold bars includes various components, such as the spread—the difference between the purchase and sale price—margins for manufacturers and sellers. Additional costs include transportation and insurance, which influence the final price. Despite these costs, gold bars are highly liquid on the global market, making them an attractive choice for investors. Their value remains stable, which is utilized in regular purchase strategies to offset price fluctuations. They thus offer flexible investment opportunities and are a stable place to allocate capital.

Photo: idfmetale.pl

Photo: idfmetale.pl

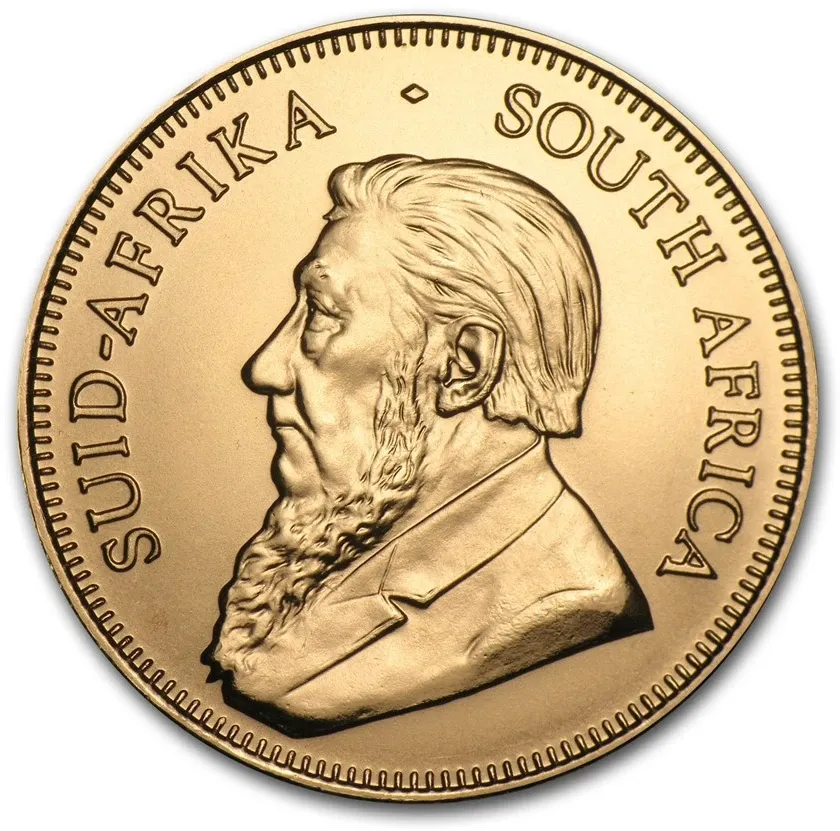

Gold Bullion Coins

Gold bullion coins are a unique investment, ideal both for experienced investors and those just starting their gold journey. Bullion coins come with certificates of authenticity, which increase their value. They are produced by reputable mints, often with LBMA accreditation, ensuring high quality and reliability. Despite additional production costs, they are a cost-effective element of portfolio diversification, especially in changing market conditions. Gold bullion coins differ from bars in several key aspects:

• they can combine investment function with aesthetic appeal,

• they have collectible value,

• they attract both individual investors and financial institutions.

You may consider purchasing them as part of a long-term investment strategy, especially if you value easy resale and security of investment.

Photo: idfmetale.pl

Photo: idfmetale.pl

Where and How to Safely Buy Investment Gold?

Buying investment gold requires careful consideration to avoid the risk of losing money. The most important is to choose trusted sources. The safest option is to use reputable sales points, such as IDF Metals. Online sales can be convenient, provided you use trusted platforms specializing in precious metals. Such platforms offer not only gold but also professional advice, helping you better understand which products are suitable for you. When purchasing gold, it is advisable to:

• check current gold prices,

• analyze currency exchange rates,

• remember about delivery costs,

• consider margins,

• account for other additional fees.

This makes it easier to determine the best time to invest. Before making a purchase, ensure you receive a certificate of authenticity with the product. Avoid buying gold from anonymous sellers and on unregulated markets.

Photo by idfmetale.pl

Photo by idfmetale.pl

Storage and Sale of Investment Gold

The best way to store it is in a home safe, bank deposit box, or using the services of deposit dealers. Gold bars are usually in certified packaging, such as CertiPack. They protect against damage and confirm authenticity. If you remove a bar from such packaging, it may affect its future sale and value. Also, ensure you have appropriate insurance coverage to protect against theft or other unforeseen situations. If you plan to sell, you can do so through dealer buybacks, precious metals exchanges, or online. This provides flexibility to tailor the sale to your needs. The price of gold at sale depends on many factors such as market quotations, exchange rates, and local supply and demand. Before the transaction, it’s advisable to compare offers to get the best conditions. Every investment carries risks because the gold market is volatile. Its value can fluctuate due to global economic or political situations. If you plan a longer-term investment, hold the gold for at least six months. This way, you can avoid capital gains taxes and reduce transaction costs. The basic principles are:

• proper storage and knowledge of gold sale rules,

• keeping documentation, invoices, and certificates,

• using appropriate insurance policies,

• selling tailored to personal needs,

• analyzing market conditions for better transaction terms.

Remember these principles to facilitate future sales and confirm the authenticity of your gold. This way, you will secure your investments and maintain a stable position in your portfolio.

Sponsored article